Streamline Your Finances: The Power of Accounts Payable Automation

In today’s fast-paced business environment, efficiency and accuracy are crucial for success. One area where companies often struggle to maintain these standards is in managing their accounts payable (AP) processes. Accounts payable automation is a game-changing solution that can revolutionize how organizations handle their financial obligations. In this blog post, we’ll explore the benefits, key features, and implementation strategies of AP automation, and discuss why it’s an essential tool for modern businesses.

The Challenge of Manual Accounts Payable

Traditional manual AP processes involve a multitude of repetitive and time-consuming tasks. These include receiving invoices, data entry, verification, approvals, and payment processing. Not only is this labor-intensive, but it’s also susceptible to errors, delays, and compliance issues. Moreover, it hinders a company’s ability to access real-time financial data, make informed decisions, and scale operations efficiently.

The Solution: Accounts Payable Automation

Accounts payable automation is the digitization and streamlining of AP processes using technology solutions such as software applications, artificial intelligence (AI), and robotic process automation (RPA). It offers a host of benefits that can transform the way your business handles its financial obligations:

- Cost Savings: AP automation reduces the need for manual labor, minimizing errors and reducing labor costs associated with data entry and invoice processing. It also helps avoid late payment penalties and capture early payment discounts.

- Enhanced Accuracy: Automation significantly reduces the risk of human errors that often occur during data entry or invoice matching. This ensures that financial records are more accurate, reducing the chances of compliance issues and costly mistakes.

- Efficiency and Speed: With automation, invoices can be processed and approved much faster, accelerating the payment cycle. This not only strengthens supplier relationships but also allows for better cash flow management.

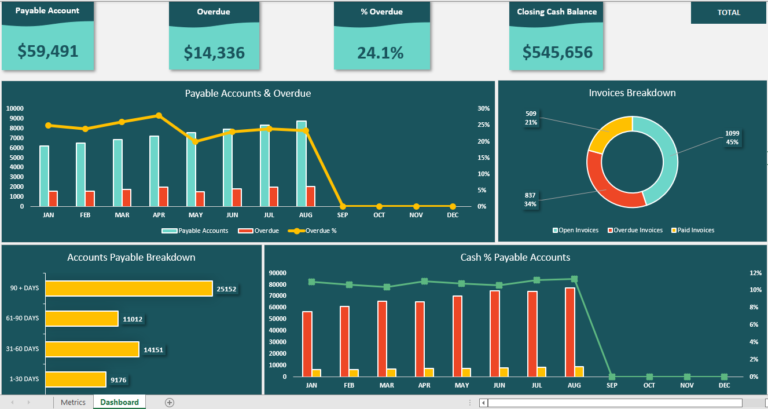

- Improved Visibility: AP automation provides real-time visibility into the AP process. Companies can track invoice statuses, monitor payment timelines, and generate reports on financial obligations, enhancing decision-making and financial planning.

- Enhanced Compliance: Automation ensures that invoices and payments adhere to company policies and regulatory requirements, reducing the risk of non-compliance and associated penalties.

Key Features of AP Automation

To fully harness the benefits of AP automation, it’s important to understand its key features:

- Electronic Invoice Capture: Scanning or digital submission of invoices into the system for processing.

- Invoice Data Extraction: Automated extraction of essential data from invoices, reducing manual data entry.

- Workflow Automation: Routing invoices through predefined approval workflows, streamlining the approval process.

- Vendor Management: Centralized management of vendor data, including payment terms and history.

- Document Storage and Retrieval: Secure storage of invoices and associated documents for easy retrieval and auditing.

- Integration: Integration with existing financial systems, ERPs, and other software to ensure seamless data flow.

Implementation Strategies

Implementing AP automation successfully requires careful planning and execution:

- Assessment: Begin by assessing your current AP processes to identify pain points and areas that can benefit from automation.

- Select the Right Solution: Choose a reliable AP automation solution that aligns with your business needs, considering factors like scalability and integration capabilities.

- Training: Ensure that your team is well-trained on the new system to maximize its effectiveness.

- Change Management: Implement a change management strategy to help employees adapt to the new system and processes.

- Continuous Improvement: Regularly monitor and evaluate the effectiveness of your AP automation solution, making adjustments as needed.

Conclusion

Accounts payable automation is no longer a luxury but a necessity for modern businesses looking to streamline their financial processes, reduce costs, improve accuracy, and enhance decision-making. By implementing AP automation, your organization can position itself for greater efficiency, compliance, and competitiveness in today’s dynamic business landscape. Embrace the future of finance by embracing AP automation and gain a competitive edge in your industry.